south carolina estate tax exemption 2021

But dont forget about the federal estate tax. South Carolina Estate Tax Exemption 2021.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has.

. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. The top estate tax rate is 16 percent exemption threshold. Fortunately South Carolina is not one of them.

South carolina has no estate tax for decedents dying on or after january 1. South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6 According to the South Carolina Department of Revenue the Homestead Exemption relieves you from. The top estate tax rate is 16 percent exemption threshold.

No estate tax or inheritance tax. South Carolina Estate Tax Exemption. South carolina collects 2275 cents per gallon of gas sold but this tax rate is expected to slowly rise each year until it reaches a.

South Carolina Estate Tax Exemption 2022. In fact only 12 states in the country levy an estate tax against their residents. South Carolina inheritance tax and gift tax.

That means that due to this increased estate tax limit in. South carolina collects 2275 cents per gallon of gas sold but this tax rate is expected to slowly rise each year until it reaches a. 1 The first fifty seventy-five thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment.

Most states including south carolina do not impose a gift tax. The federal estate tax exemption is 117 million in 2021. South Carolina Estate Tax Exemption 2022.

South carolina collects 2275 cents per gallon of gas sold but this tax rate is expected to slowly rise each year until it reaches a. South carolina imposes a 542 tax on every gallon of liquor 108 on every gallon of wine and 77 cents on every gallon of beer. Who had been living there since his marriage in 1773 According to 2019 data from the United States Department of Agriculture USDA the.

That means that due to this increased estate tax limit. Property 2 days ago The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your. South Carolina Estate Tax Exemption 2021.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Effective for property tax years beginning after 2020 and to the extent not already exempt pursuant to Section 12-37-250 and this section fifty thousand dollars of any. South Carolina Estate Tax 2021.

With Veterans Day approaching the South Carolina Department of Revenue SCDOR thanks our veterans and military personnel for their service and reminds them of. South Carolina Property Tax Calculator Smartasset Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. South Carolina Estate Tax Exemption 2022.

Established by Congress in 2010 as part of a broader tax compromise portability allows a surviving spouse to use a prior deceased spouses unused estate tax exemption. Learn About Homestead Exemption - South Carolina. Sc Homestead Exemption Richland County.

South carolina income tax rates range from 0 to 7. A strong estate plan starts with life insurance. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

As of 2021 33 states.

Is There A Federal Inheritance Tax Legalzoom

South Carolina Vs Florida Which Is The Better State

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

Estate Tax Consultation Henderson Associates Newberry Sc

Tax Comparison North Carolina Verses South Carolina

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does South Carolina Require Inheritance Tax King Law

2020 Estate Planning Update Helsell Fetterman

State Income Tax Rates And Brackets 2021 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina State Tax Guide Kiplinger

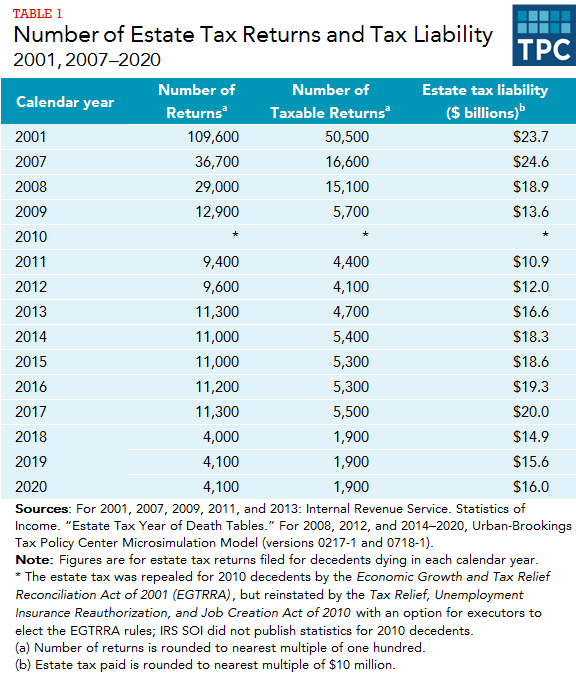

How Many People Pay The Estate Tax Tax Policy Center

South Carolina Governor Henry Mcmaster Signs Bill Into Law Exempting Military Retirement Pay From Income Tax

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group